Financials

Quarterly Report For The Financial Period Ended 30 September 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

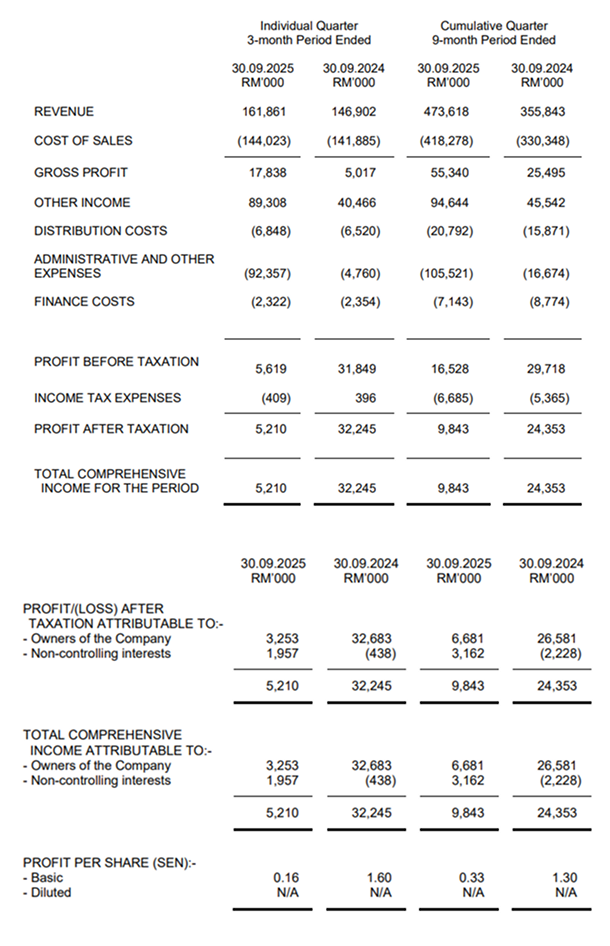

Condensed Consolidated Statement of Profit or Loss and Other Comprehensive Income

For the 3rd Quarter Ended 30 September 2025

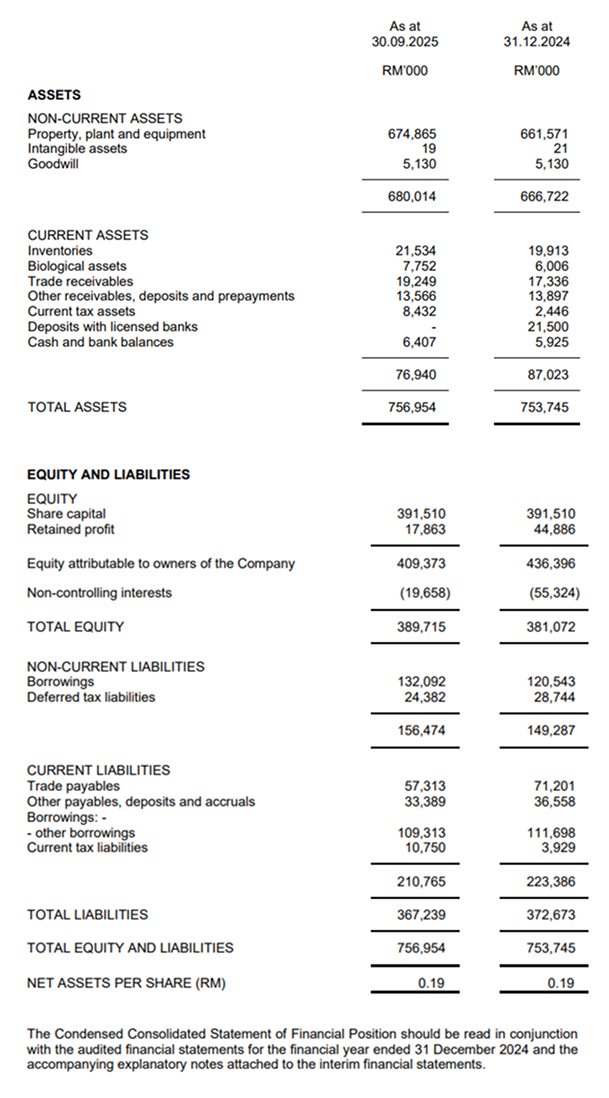

Condensed Consolidated Statement of Financial Position

As at 30 September 2025

Review of performance

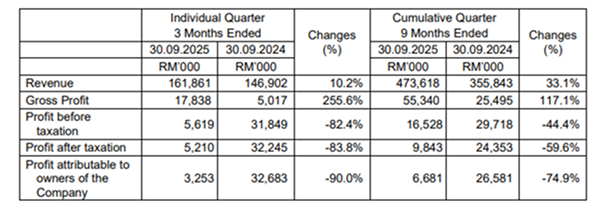

Financial review for current quarter and financial year to date

3 Months Ended 30.09.2025 vs 30.09.2024

For the three months ended 30 September 2025, the Group reported total revenue of RM 161.9 million, representing a 10.2% increase compared to RM146.9 million in the corresponding period of 2024. The modest increase in revenue was largely attributable to higher selling prices for FFB, CPO, and PK, which rose by 12.2%, 6.7% and 30.8%, respectively. During the period, PK sales volume recorded a slight increase of 0.1%, whereas CPO and FFB volumes decreased by 0.4% and 1.0%, respectively, compared with the same period in 2024. As a result of these factors, the gross profit surged by 255.6% to RM 17.8 million from RM 5.0 million. Notwithstanding this, the company recorded an 82.4% drop in profit before taxation, alongside an 83.8 % decrease in profit after taxation. The profit attributable to the owners of the company dropped to profit of RM 3.3 million by 90.0% from profit of RM32.7 million in the year 2024.

9 Months Ended 30.09.2025 vs 30.09.2024

For the nine months ended 30 September 2025, revenue increased by 33.1%, from RM355.8 million to RM473.6 million. Gross profit boosted by 117.1% to RM55.3 million from RM25.5 million, driven by higher selling prices and sales volumes of FFB, CPO, and PK. FFB sales volume increased slightly by 0.6% and its selling price rose 15.2%. CPO sales volume and price increased by 22.0% and 8.7%, respectively, while PK sales volume and price grew by 15.1% and 45.2%. In contrast, profit before tax declined by 44.4% to RM16.5 million, and the profit after taxation decreased by 59.6% to RM 9.8 million, compared with the corresponding period in 2024. Similarly, the profit attributable to owners fell by 74.9% to RM6.7 million.

Commentary on Prospects

The outlook for Malaysia's oil palm industry remains generally positive, supported by structural supply constraints, ageing tree profiles, and strong biodiesel demand from Indonesia, which together help sustain medium-term price strength. However, CPO prices have softened recently due to rising Malaysian stockpiles, slower export momentum, and improving supply from competing vegetable oils such as soybean oil, which has reduced palm oil's price competitiveness. Seasonal peak production has also contributed to a temporary oversupply, adding downward pressure on prices. Despite this short-term weakness, analysts still project firm demand from major importers like India and expect prices to stabilize once inventories normalize, keeping the industry's broader prospects stable and supported in the coming quarter.